All what you need to know about KSA Electronic invoices

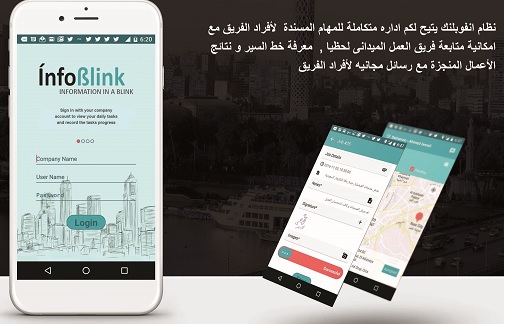

Infoblink team have studied all the documents related to the requirements and adjusted the system and the App to be compliant.

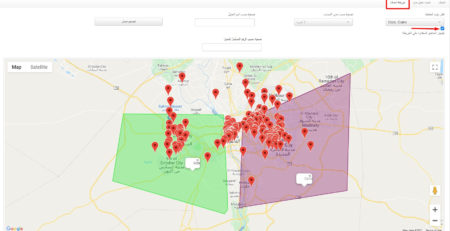

Whether you are using the system dashboard or the App, you can easily create “Tax invoice” or “Simplified Tax Invoice with QR Code” as per the guidelines of ZATCA.

Infoblink obtained the appproval of ZATCA as solution provider, and will be glad to assist you in the journey of switching from paper invoices to the electronic invoices.

For more details about the requirements and the precautions, please check the arabic version of this article, or feel free to contact our support to get a free consultation.

Phone or whatsapp: 00201003176331

Leave a Reply